Mauritania's National Bank partners with Mobiblanc and Skaleet to launch mobile payment solution.

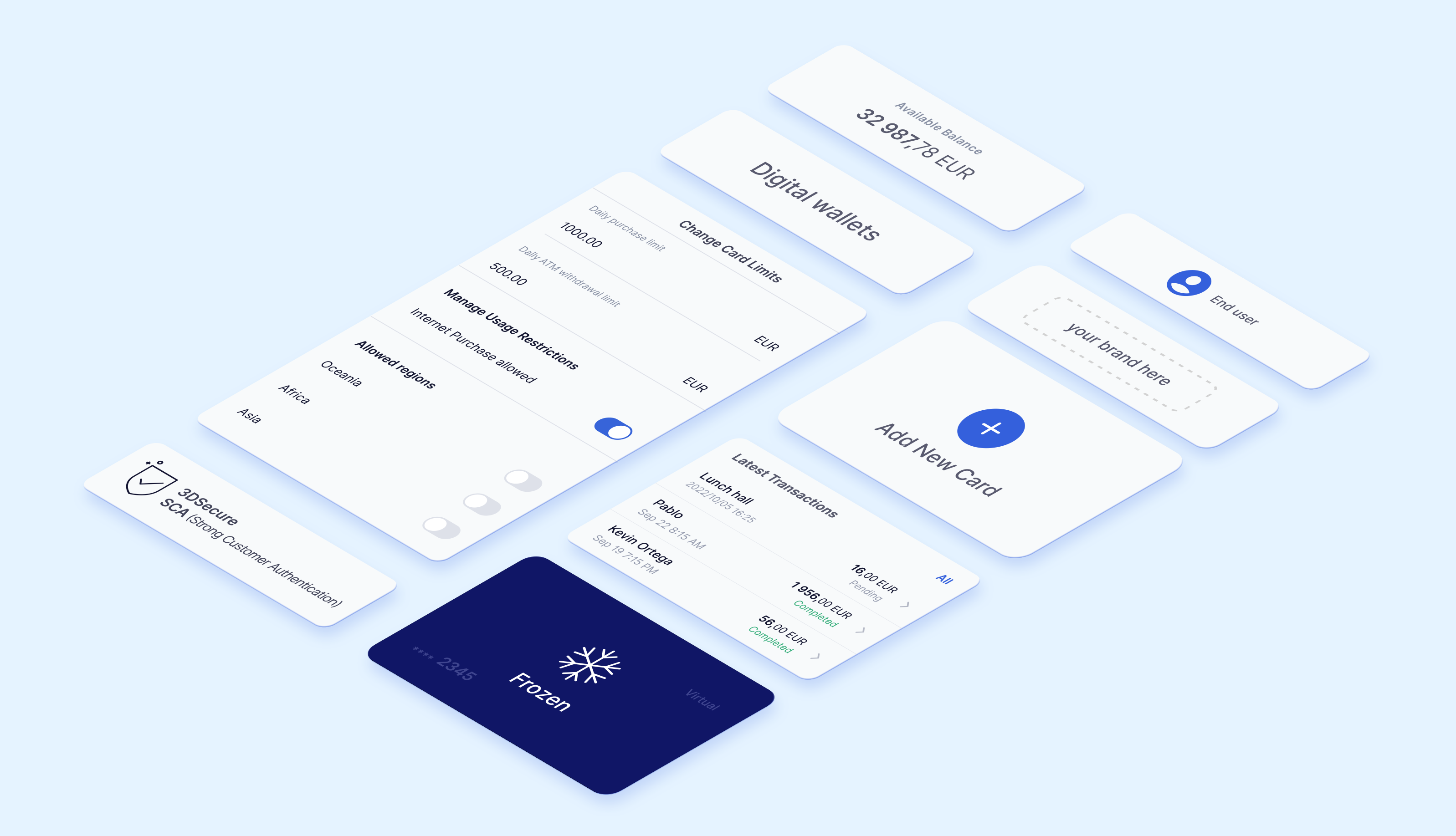

Mobiblanc Money, an auxiliary of ESN Light-footed Mobiblanc, and Skaleet, a global FinTech giving a Center Financial Stage, have quite recently declared the send off of another versatile installment project with the Public Bank of Mauritania (BNM). On the system of the Procedure for Sped up Development and Shared Success (SCAPP), the fundamental target of which is to lead Mauritania to monetary rise by 2030, the BNM, plays a pivotal part to play as far as monetary consideration and massification of electronic installment techniques means to furnish individuals with a computerized financial stage and a portable installment arrangement, by offering legitimate delicate electronic cash to satisfy the need coming about because of the decrease in the utilization of money in installment exchanges. Mobiblanc is uniting with Skaleet to help the BNM in its computerized change venture towards present day solutions. The mechanical organization between Mobiblanc Money and Skaleet will guarantee the generally useful and specialized extent of the BNM's e-Wallet "Snap" portable application. The nimbleness of these players in the North and West African market joined with the mastery of the financial area is a mechanical decision of greatness for monetary organizations.